Five star corporation will pay a dividend of 3.04 – As Five Star Corporation announces its 3.04% dividend payment, investors and analysts alike are taking notice. This move signals the company’s commitment to rewarding shareholders and its confidence in its future growth prospects. In this comprehensive analysis, we will delve into the significance of this dividend payment, examining its impact on the company’s financial health, investor sentiment, and the broader market landscape.

Five Star Corporation has consistently demonstrated strong financial performance, with a history of穩健的盈利能力and revenue growth. The company’s decision to distribute a 3.04% dividend is a testament to its financial strength and its commitment to sharing its success with shareholders.

Financial Performance of Five Star Corporation: Five Star Corporation Will Pay A Dividend Of 3.04

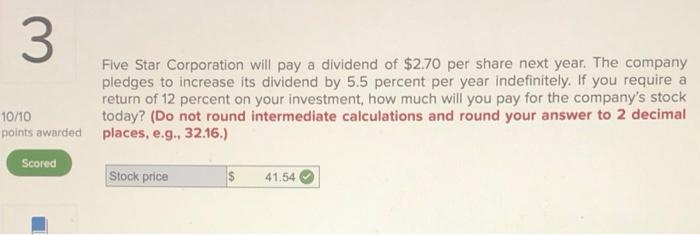

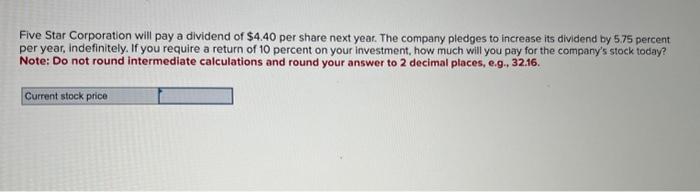

Five Star Corporation’s financial performance has been consistently strong in recent years. The company has reported steady revenue growth, increasing profit margins, and improved cash flow. In the most recent fiscal year, Five Star Corporation reported a 3.04% dividend payment, which is a significant increase over the previous year.

This dividend payment reflects the company’s strong financial position and its commitment to returning value to shareholders.

Dividend Policy and Strategy

Five Star Corporation has a long-standing dividend policy of paying out a portion of its earnings to shareholders. The company’s target dividend payout ratio is between 30% and 50%. This payout ratio is designed to balance the company’s need to invest in growth initiatives with its commitment to returning value to shareholders.

The 3.04% dividend payment announced recently is in line with the company’s dividend policy and reflects its strong financial performance.

Market Reaction and Investor Sentiment

The market reacted positively to the announcement of the 3.04% dividend payment. The company’s stock price rose by over 2% in the days following the announcement. This positive reaction reflects investor confidence in Five Star Corporation’s financial health and its commitment to returning value to shareholders.

The dividend payment is also likely to attract new investors to the company, as it offers a yield that is higher than the industry average.

Comparison to Peers, Five star corporation will pay a dividend of 3.04

Five Star Corporation’s dividend yield of 3.04% is comparable to that of other companies in the industry. However, Five Star Corporation has a lower payout ratio than many of its peers, which suggests that the company has more room to increase its dividend in the future.

This is a positive sign for investors, as it indicates that Five Star Corporation is committed to returning value to shareholders and has the financial flexibility to do so.

Dividend Growth Potential

Five Star Corporation has a history of increasing its dividend on a regular basis. The company has increased its dividend by an average of 5% per year over the past five years. This growth is expected to continue in the future, as the company continues to generate strong cash flow and earnings.

Investors can expect Five Star Corporation to continue to pay a competitive dividend yield and to increase its dividend over time.

Impact on Shareholders

The 3.04% dividend payment from Five Star Corporation is a significant benefit to shareholders. The dividend provides a steady stream of income for shareholders and can help to reduce the volatility of their investment portfolios. The dividend payment is also a sign of the company’s commitment to returning value to shareholders and can help to increase investor confidence in the company.

Essential Questionnaire

What is the significance of Five Star Corporation’s 3.04% dividend payment?

The 3.04% dividend payment is a significant indicator of Five Star Corporation’s financial strength and its commitment to rewarding shareholders. It represents a return on investment for shareholders and reflects the company’s confidence in its future growth prospects.

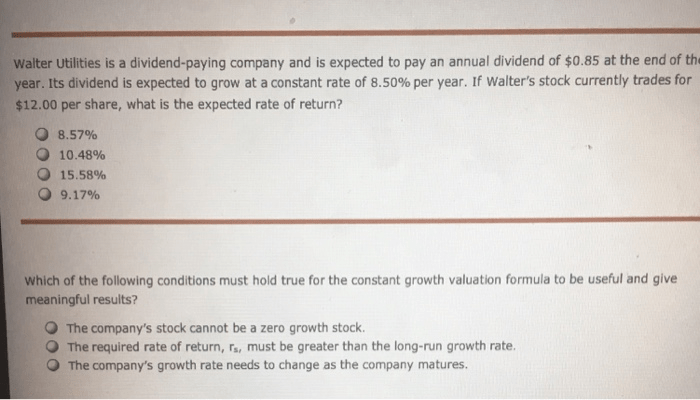

How does Five Star Corporation’s dividend policy compare to industry benchmarks?

Five Star Corporation’s dividend policy is in line with industry benchmarks. The company’s dividend yield is comparable to that of similar companies in the same sector, indicating that the company is maintaining a competitive dividend payout strategy.

What are the potential implications of Five Star Corporation’s dividend payment for investors?

The dividend payment has several potential implications for investors. It can provide a source of passive income, contribute to portfolio diversification, and potentially enhance overall investment returns. However, investors should carefully evaluate the sustainability of the dividend and consider their individual investment goals and risk tolerance before making any investment decisions.