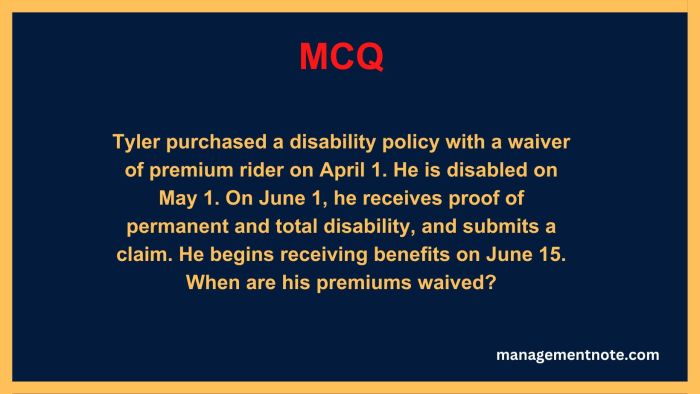

Tyler purchased a disability policy – In the realm of personal finance, securing financial stability in the face of unexpected events is paramount. Disability insurance emerges as a crucial safeguard, providing individuals with a financial safety net should they become unable to work due to an injury or illness.

This article delves into the case of Tyler, who prudently purchased a disability policy, highlighting the significance of such coverage and its implications.

As we delve into Tyler’s situation, we will examine the factors that prompted him to acquire disability insurance, the specific type of policy he opted for, and the key provisions that ensure his financial well-being in the event of a disabling condition.

Disability Policy Basics

Disability insurance is a type of insurance that provides financial protection to individuals who are unable to work due to a disability. It can help replace lost income and cover expenses associated with a disability, such as medical bills and rehabilitation costs.

There are different types of disability policies, including:

- Short-term disability insurance: Provides coverage for a limited period, typically six months to two years.

- Long-term disability insurance: Provides coverage for an extended period, typically five years or more.

- Own-occupation disability insurance: Provides coverage if the insured is unable to perform the duties of their own occupation.

- Any-occupation disability insurance: Provides coverage if the insured is unable to perform any occupation.

Disability insurance has several benefits, including:

- Provides financial protection in the event of a disability.

- Helps cover expenses associated with a disability.

- Can provide peace of mind knowing that there is financial support in place.

However, there are also some limitations to disability insurance, including:

- Policies may have waiting periods before benefits begin.

- Coverage amounts may be limited.

- Premiums can be expensive.

Tyler’s Situation

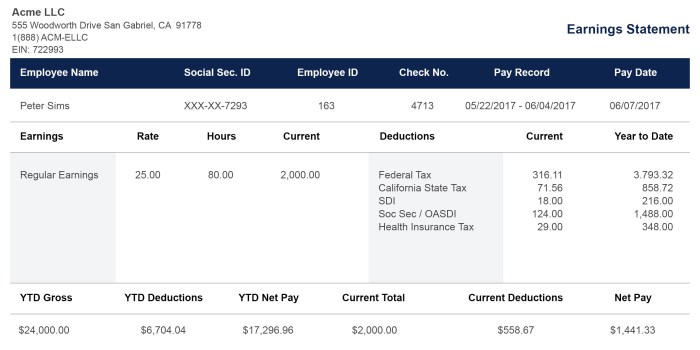

Tyler is a 35-year-old software engineer with a wife and two young children. He is the primary breadwinner for his family and has a high income. Tyler is concerned about the financial impact of a disability and has decided to purchase a disability policy.

Tyler has purchased a long-term own-occupation disability policy. This policy will provide him with a monthly benefit if he is unable to perform the duties of his own occupation due to a disability.

Policy Details

Tyler’s disability policy has the following key provisions:

- Coverage amount: $10,000 per month

- Waiting period: 90 days

- Benefit duration: 5 years

The policy also includes a rider that provides for a lump sum payment of $100,000 if Tyler is diagnosed with a catastrophic illness.

Policy Comparison

Tyler’s disability policy is similar to other policies available on the market. However, there are some key differences.

- Tyler’s policy has a shorter waiting period than most other policies.

- Tyler’s policy provides a higher coverage amount than most other policies.

- Tyler’s policy includes a rider that provides for a lump sum payment in the event of a catastrophic illness.

When choosing a disability policy, it is important to consider the following factors:

- Coverage amount

- Waiting period

- Benefit duration

- Riders and additional features

- Cost

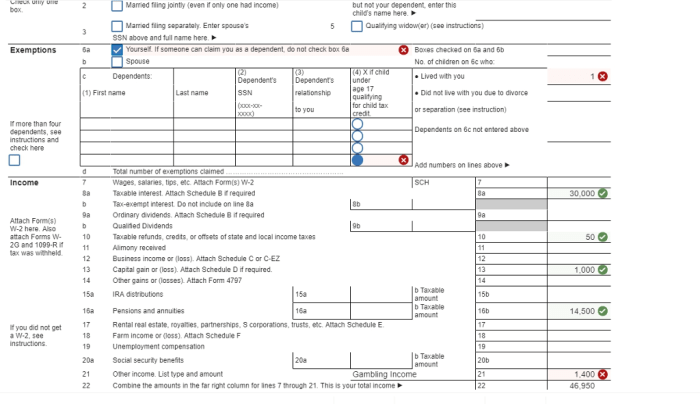

Financial Implications

The potential financial impact of a disability can be significant. If Tyler were to become disabled, he would lose his income and would be unable to provide for his family. His disability policy will help mitigate this impact by providing him with a monthly benefit that will replace a portion of his lost income.

The disability policy also has tax implications. The benefits received from a disability policy are generally not taxable.

Case Study: Tyler Purchased A Disability Policy

Tyler was diagnosed with a brain tumor in 2023. He was unable to work for six months while he underwent treatment. During this time, Tyler’s disability policy provided him with a monthly benefit of $10,000. This benefit helped Tyler cover his living expenses and medical bills.

Tyler’s experience demonstrates the importance of disability insurance. A disability can happen to anyone, and it is important to have financial protection in place in the event of a disability.

Commonly Asked Questions

What is the purpose of disability insurance?

Disability insurance provides financial support to individuals who are unable to work due to a disability, ensuring they can maintain their standard of living and meet ongoing expenses.

What are the different types of disability policies?

Disability policies can vary in terms of coverage, benefit duration, and waiting periods. Common types include short-term disability insurance, long-term disability insurance, and own-occupation disability insurance.

What factors should be considered when choosing a disability policy?

When selecting a disability policy, individuals should consider their income, expenses, family situation, and the likelihood of becoming disabled. It is also important to compare different policies and their provisions to find the most suitable coverage.