Read and interpret pay stubs answer key – Unlocking the intricacies of pay stubs is crucial for financial literacy and informed decision-making. This comprehensive guide, “Mastering Pay Stubs: A Comprehensive Guide to Reading and Interpretation,” delves into the key components and nuances of pay stubs, empowering individuals to decipher and leverage this valuable financial document.

Understanding gross and net pay, deciphering deductions and taxes, and utilizing pay stubs for financial planning are essential aspects of managing personal finances effectively.

Understanding Pay Stubs

A pay stub is an official document provided by an employer to an employee that details the employee’s earnings, deductions, and net pay for a specific pay period.

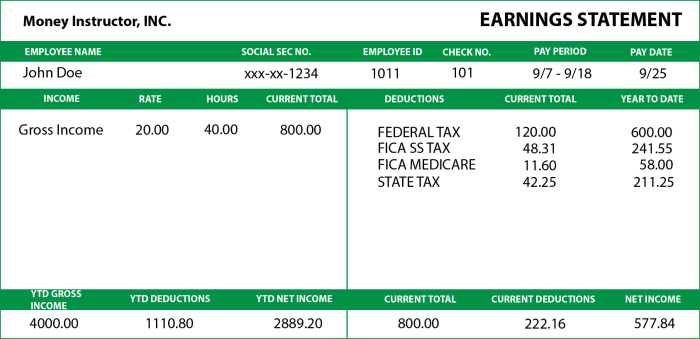

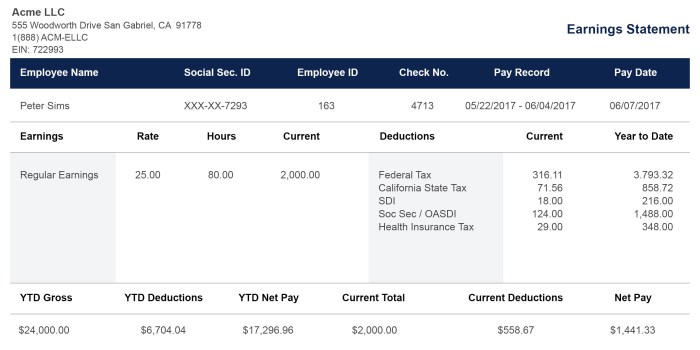

The key sections of a pay stub typically include:

- Employee information (name, address, Social Security number)

- Pay period dates

- Gross pay (total earnings before deductions)

- Deductions (taxes, insurance premiums, retirement contributions)

- Net pay (amount of pay received after deductions)

Reading Pay Stubs

To effectively read a pay stub, it’s important to:

- Review the pay period dates to ensure they are accurate.

- Identify the gross pay and net pay amounts.

- Understand the different types of deductions and their purposes.

- Check for any errors or inconsistencies.

Understanding gross and net pay is crucial because:

- Gross pay represents the total amount earned before deductions.

- Net pay is the amount of pay received after deductions and is the actual amount deposited into the employee’s bank account.

Interpreting Pay Stubs: Read And Interpret Pay Stubs Answer Key

Common deductions on pay stubs include:

- Federal income tax:Tax withheld for federal income tax.

- Social Security tax:Tax withheld for Social Security benefits.

- Medicare tax:Tax withheld for Medicare benefits.

- State income tax:Tax withheld for state income tax (if applicable).

- Health insurance premiums:Employee’s share of health insurance coverage.

- Retirement contributions:Employee’s contributions to a retirement plan, such as a 401(k).

Taxes play a significant role in pay stub calculations, as they are withheld from gross pay to fund government programs and services.

Analyzing Pay Stubs

Potential errors or inconsistencies in a pay stub may include:

- Incorrect pay period dates

- Miscalculations of gross or net pay

- Deductions that are not authorized or incorrect in amount

- Missing or incomplete information

Pay stubs can be used for financial planning by:

- Tracking income and expenses

- Identifying areas where spending can be reduced

- Projecting future income and expenses

To calculate take-home pay using a pay stub:

- Subtract all deductions from gross pay.

- The resulting amount is the net pay.

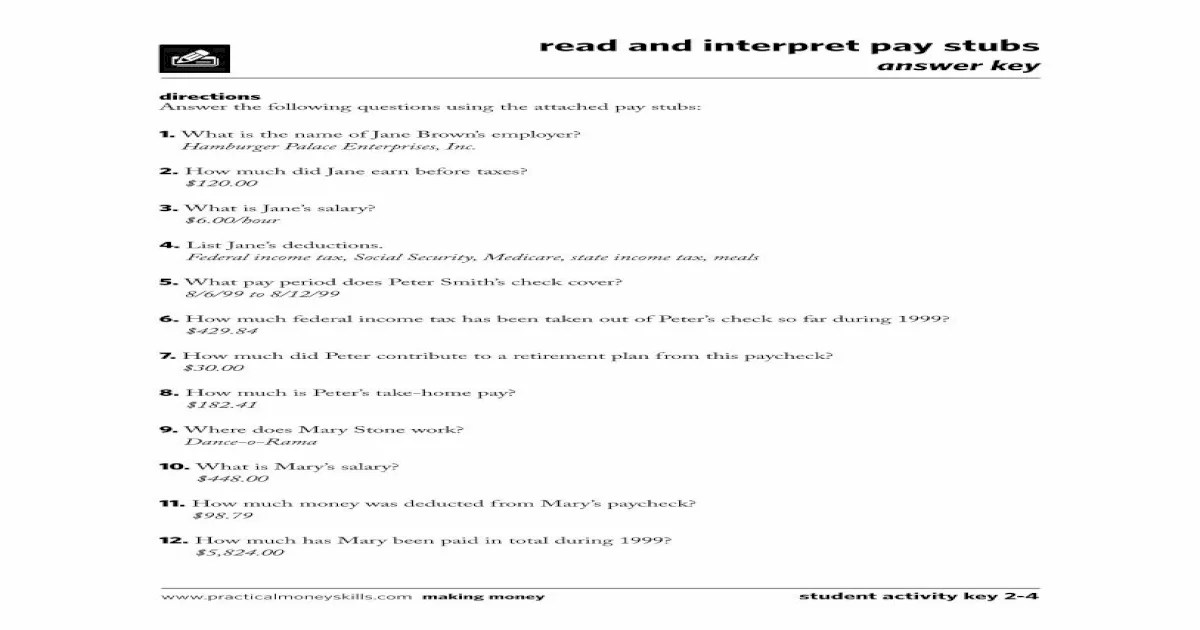

Key Questions Answered

What is the purpose of a pay stub?

A pay stub provides a detailed record of an employee’s earnings, deductions, and net pay for a specific pay period.

How can I identify potential errors or inconsistencies in a pay stub?

Carefully review the pay stub for any discrepancies between hours worked, pay rate, deductions, and net pay. If any irregularities are found, contact the payroll department for clarification.